How to Start Investing With Very Little Money

Last week we had the first Creating Money Magic life class for this “semester”.

As part of the classes I invite guest speakers to share their secrets on investments, entrepreneurship, branding and anything that ties to wealth creation.

My focus has evolved from paying off debt to investing and creating wealth.

One thing I’ve learned on this journey is that to change our lives we not only have to change the way we think and feel; about money, we also have to change the way we behave with money.

Yes, we’re spiritual beings but we’re on this plane to have a physical experience which means we have to work with earthly laws, and money is one of those earthly things we have to work with.

Unfortunately financial freedom doesn’t come from having a good paycheck but from making money work for us.

And money works for us by exploiting the power of compound interest to give birth to more money.

But what if I don’t have enough money to invest?

People tell me this all the time, so I decided to invite my Financial Advisor, Chenine Gouws, to the class to share some her insights on how to start investing with very little money.

Chenine, went really deep with the students in the Creating Money Magic course, so I’m just going to share the basics in this blog post.

1. BUDGET

If you don’t have enough money to invest because you’re paying off debt or have high monthly expenses, then you have to find a way to free up money every month.

I know it seems impossible; 5 years ago I had no money – I hadn’t made money in 2 years, was heavily in debt and broke. I was convinced I’d never find the money to save or invest; in fact it took me 2 years to start an investment portfolio.

I’m still sad that I wasted 2 years convincing myself I didn’t have money; when it comes to investing time is everything.

When I finally made the decision to do this thing, I went to my budget, looked at what I could cut back on and found creative ways to make extra income and use money differently. And what do you know – I found the money to save and invest.

2. Pay back debt as fast as possible

3. Savings matter and no amount is too small

The belief that we need to save lots of money from the get go is the one thing that holds us back from saving.

Don’t get it twisted - saving is important because we can use our savings for emergencies (instead of using debt) and we can use our savings as investments.

Even if you start saving a little money, it grows and becomes more with time.

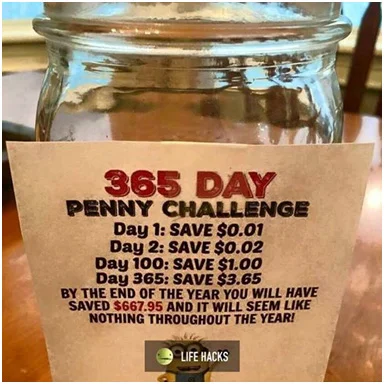

Recently 2 women on Facebook sent me the following pictures to show me how they’ve been saving with “pennies” and much that is in a year.

One is based in the Caribbean so she followed the US Dollar savings:

The other is South African and she started off saving R10 on day 1:

4. Tax breaks on savings

Yes you read that right – if you’re in South Africa you can open up a tax free account, which means that the first R30 000 in that account is tax free.

Just be careful to check fees on these accounts because most banks, have ridiculous fees for these accounts.

So now you’ve freed up some money what can you invest in?

This is the key question that people always ask me – so we asked Chenine to share her wisdom and here’s what she said:

1. Unit Trusts

Unit trusts are the easiest vehicle for South Africans to invest in. They're similar to mutual funds - they’re a collective investment in various shares and just like mutual funds they all have varying degrees of risk.

The great thing with unit trusts is that you can start investing now and you only need R200 a month to get started. You can withdraw the money any time without any penalties; it usually takes 2 – 3 business days to get the money.

This ease of access to funds makes unit trusts ideal to use for your emergency savings account (the rule of thumb is you need to have at least 6 months’ salary saved).

To see decent returns on investment, you have to plan to invest for at least 5 or 10 years.

To start investing you can just go into a bank or financial services company and sign up.

Unfortunately unit trusts, like mutual funds, have managers which mean there’s a down side: fees.

The fees don’t seem high (1%) but they do eat into your returns and profits, especially in the long run. So you just have to be careful and read the small print.

Tax: Yes, you have to pay capital gains tax (tax on profit) for unit trusts but the good news is, according to South African tax laws, you’re eligible for a R40 000 tax deduction on your gains, which decreases the amount of tax you pay.

2. Endowment funds (endowments)

Usually an endowment is a donation but in the investment world, in South Africa, an endowment is similar to a unit trust - you pay a certain amount into an investment every month but unlike unit trusts you’re not buying parts of shares, more like you’re buying something that houses those funds.

And unlike unit trusts, there’s a minimum fee, a minimum investment period (usually 5 years minimum period) and you can’t withdraw money until that period comes due.

If you do take the money beforehand, you get penalized with insane fees (been there and done that) and you can only make one withdrawal throughout the entire period.

Tax: Endowments are actually created for tax reasons, so they’re a great vehicle for people who are in a high tax bracket. There’s a limit on how much you can be taxed with endowments, which is music to my ears (believe that) and the main reason I invest in endowments.

3. Retirement annuity

Thanks to my lifestyle, I’m in charge of my own retirement.

I have no employer to help me out with a pension fund contribution so I have a retirement annuity, which is perfect for entrepreneurs and other people that have to sort out their own retirement.

In South Africa a Retirement Annuity allows you to save for your retirement; you have to pay a minimum of R200 a month to get started and when you retire you can take up to one third of your savings in a lump sum and the remaining money is given to you as a monthly income.

There are many different retirement annuities to choose from and you can do it on your own online or you can use an advisor.

A major benefit of retirement annuities is that the money is protected against creditors; if you ever declare bankruptcy or anything, creditors can’t touch this money.

The downside is you can’t touch the money either, at least not until you turn 55 years.

Tax: The upside is that the money you pay into your retirement annuity reduces your taxable income and there’s no capital gains tax on any of the money in your retirement annuity.

4. Pension funds

This is similar to a retirement annuity, except your employer offers you membership and decides on who to invest the pension fund with.

Usually the employer allows you to choose how much of your salary you save for retirement but sometimes they can make the choice for you.

So there you have it, this is how you can start building an investment portfolio with very little money.

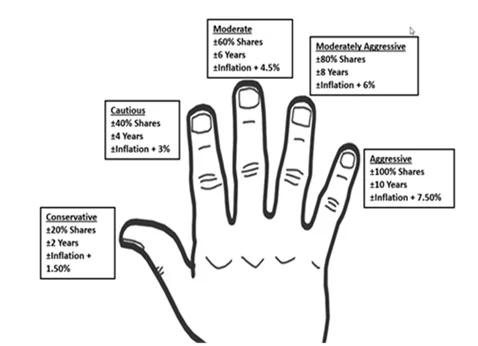

I know I didn’t mention shares on here but Chenine explained that shares are a high risk investment and you should only invest in shares if you have extra income. I think shares are great but I’m a passive investor, which means I don’t see the value in actively trading shares on the market.

In South Africa you need a large lump sum to start investing in the market, but there are alternatives, like ETFs (Exchange Traded Funds) and Satrix, which don’t require as much money.

Personally I spent the first part of my personal finance journey taking care of basics – getting out of debt, building up on savings, beefing up on retirement investments, getting life insurance, building a credit score, getting endowments etc.

And only then did I move onto more exciting things like shares.

Below is an image that shows the general rule of thumb on risk profile and the weight of shares in your portfolio:

You may also want to check out the How to Start Investing: A Beginners Guide over at LendEDU. The guide explains how to invest in stocks, mutual funds, ETFs, bonds, real estate, and retirement. Also included is the expected returns for each item listed.

Let me know your thoughts on investments in the comments section below.

Or share the Facebook live video below