My name is Vangile Makwakwa, and I want to take a moment to share a deeply personal journey that led me to where I am today.

I’m a money trauma coach on a mission to help primarily women of colour heal intergenerational money trauma so they can become financially free. I came to do this work after getting my finance degree from the University of Cape Town (UCT ) in Cape Town, South Africa and then my MBA from the Simmons School of Management in Boston, AM.

Right after that, I started struggling with panic attacks around money.

I would have panic attacks whenever I would withdraw money, touch money, or even talk about money. Added to that, after graduating, I was also $60,000 in debt (that's about R1m today), and all I could do was think about money, worry about money…

I tried affirmations, visualisations, I tried going back to what I had learned at school about finances: I knew about budgeting, I knew how to talk about economics and inflation, supply and demand, but I couldn't translate any of that into my finances, into my personal finances, which is how I started to do this work.

My first book Heart, Mind and Money published in 2014 looked at the link between emotions and money.

But as I grew deeper into my work, I started asking myself, why do we even feel the way that we feel about money?

And I realised that a lot of that comes from our ancestral trauma and our family dynamics around money, which is what my new book is about.

What's your Money Personality? is the culmination of the sessions I’ve had the pleasure of coaching hundreds of women through. In this work, I saw how people are able to improve their finances once they understand their family dynamics and how these dynamics affect their personal behaviour and financial choices.

And I noticed that a lot of personal finance education really only focuses on finances from a very Western standpoint, which looks at money and wealth creation from a very individualistic standpoint.

But the truth is people for most of us as Black and Brown people, money isn't just an individual thing, it's very much a collective thing. How much money I make impacts my family dynamics. It impacts how I'm treated within my family.

It impacts how much I can contribute to the family unit, not just my nuclear family, but the extended family, aunts, uncles, cousins … I realised that my struggles weren't just personal; they were deeply intertwined with the broader issue of Black Tax.

This financial responsibility to financially support our extended families places a significant burden on us. It's a complex and often overwhelming reality.

In this book, I delve into 10 different personality types within families and how understanding these dynamics can revolutionise our relationship with money. It's not just about personal change; it's about influencing the entire family unit, rewriting our financial narratives, and creating paths to generational wealth.

My primary audience is Black and Brown people, particularly women who often seek help with the emotional aspects of money. This book offers a holistic perspective on money, the collective impact it has on our families, and how understanding our unique money personalities can change our behavioural patterns.

I'm beyond excited to share this journey with you all. Your support means the world to me, and I can't wait for you to have my book in your hands.

Get Your Copy of the Book at these locations:

South Africa:

The book is available at all major bookstores nationally in South Africa. If a bookstore doesn't have it you can ask them to order it from Pan MacMillan. You can also order the physical book online at these links:

Takealot - https://www.takealot.com/what-s-your-money-personality/PLID94007719

Loot - https://www.loot.co.za/product/whats-your-money-personality/jnpx-8044-g370

Exclusive Books - https://www.exclusivebooks.co.za/product/9781770108868

ORDER THE EBOOK AT THESE LINKS Online:

Amazon: https://a.co/d/iflg0Cx

Kobo: https://www.kobo.com/za/en/ebook/what-s-your-money-personality

Barnes and Noble: http://www.barnesandnoble.com/s/1144007297

Google Play Books: https://play.google.com/store/books/details/Vangile_Makwakwa_What_s_Your_Money_Personality?id=adrWEAAAQBAJ&hl=en&gl=za

Other countries:

You can order the book on

Amazon: https://a.co/d/3VQgSNo

Barnes and Noble: https://www.barnesandnoble.com/w/book/1144292902

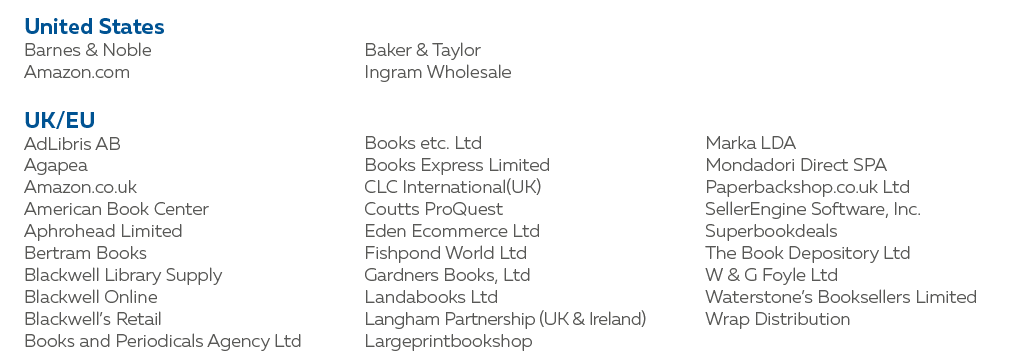

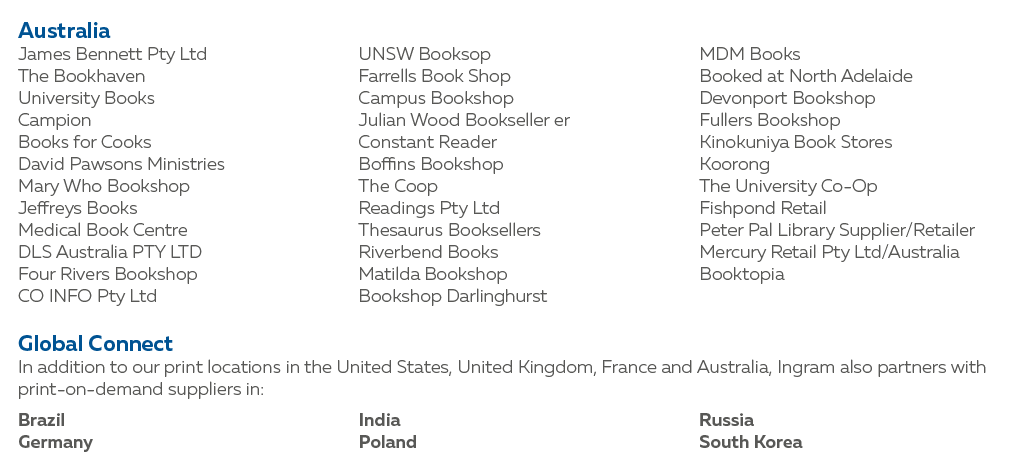

The book is available in various countries at the bookstores below. To get your copy of the book, go into the stores in the countries mentioned below and ask them to order the book: